Published on March 12, 2021 by Mrinal Shankar

The rise of alternative financing platforms, digital disruption and remote operations has made the acquisition of new customers difficult for most global financial institutions. Banking executives are increasingly prioritising the retention of existing customers, given rising customer acquisition costs (CACs) and longer acquisition cycles. While it is natural for a select group of customers to complete the lifecycle and enter the churn phase, a data-driven decision-making process can proactively reduce the overall churn rate. An effective retention strategy entails the following:

Know your customer by leveraging smart insights

Before financial institutions make substantial investments in artificial intelligence (AI) or machine learning (ML) strategies, it is important for them to analyze their existing data ecosystems. Data transformation to make the underlying datasets ready for analysis is essential to facilitate fast and accurate data analytics. Customers’ data dimensions are sourced from different databases, such as local databases, legacy systems, mainframes, clickstreams, Teradata and Hadoop, and are generally available in multiple formats of structured and unstructured data types. Given that this would involve large volumes of data, it becomes necessary to create unified data of customer by developing customer base tables at the product and segment levels with over thousands of features.

Create a data-driven churn management framework

Customer churn refers to customers ceasing the use of a company's products or services during a certain time frame. The three elements of an effective data-driven churn management framework are:

Let us consider the mortgage business to illustrate the framework. For mortgage products, churn is defined as customers refinancing an existing mortgage product through another bank or making a full prepayment before the tenure is complete. Industry figures show that more than 60% of mortgage loan applications are refinancing their existing mortgage.

Understand the 3Ws – when, why and who

The when – churn window

Identifying churn well before it actually occurs is imperative in churn management. When a customer closes an account within a short period of time (typically ranging from days to a month) from the reference time point, it is termed “hard churn”. If the account closure pans out from a couple of months to a year, it is termed “soft churn” or “silent churn”. The optimal churn window for both these situations is determined by analysing month-over-month churn rate data.

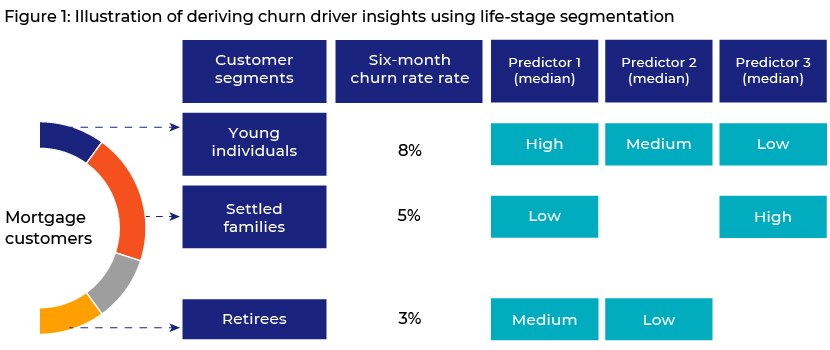

The why – churn drivers

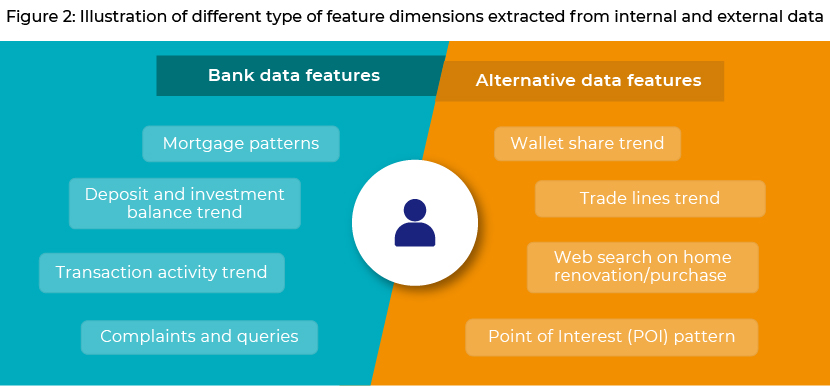

Customer 360-degree data can enable organizations to get a unified view of customers using information from both internal sources (such as product holding, balances, transactions, cost and revenue, bills, interactions, demographics, clickstreams and marketing campaigns) and external sources (such as credit bureaus, web searches and point of interest). In customer 360 data, exploratory data analysis (EDA) steps, such as bivariate analysis of churn, can generate insights on patterns of churn. Churn rates and drivers differ across demographics and customer life stages. For instance, the settled families customer segment in a mortgage business may prefer a hassle-free banking experience over differential mortgage interest rates offered by other banks. On the other hand, the young individuals segment may be more sensitive to interest rates and likely to switch to banks that offer lower rates.

Life-stage or demographic segmentation is built by leveraging unsupervised Machine Learning (ML) algorithms to generate insights on churn patterns across life-stage segments.

The who – customers likely to churn

Features engineering

Features engineering

is conducted on the customer 360 data to aid the discovery of early warning signals and patterns to predict churn. Typical features that can be extracted include the average of the past 3/6/12 months, ratio of current month to last month, ratio of averages, coefficient of variation of balances, transaction amount and transaction count.

Some important features could be (a) Declining trend in overall deposit balance – a significant reduction in deposit product balance in recent months could indicate the transfer of deposit balance to other banks. (b) Frequent mortgage account deposits, higher than monthly instalments, could signal prepayment before tenure completion. Getting such features to interact with each other can enhance model performance. For example, a decline in the deposit balance, along with the absence of inflow transactions, is a signal that funds are being diverted to other banks.

Extracting features from alternative data sources can help identify early warning signals, such as (a) a decrease in a bank’s wallet share– declining trend in month-over-month wallet share can indicate a transition from the primary bank to a secondary and is a signal of soft churn and (b) customer’s web search activity related to loan refinancing and comparison of interest rates – could imply that the customer is looking to refinance the existing mortgage loan.

Predictive modelling

Churn prediction modelling is a standard classification methodology. It is important to capture both hard churn and soft churn customer data, by building a single model or two separate models. Modelling techniques such as XGBoost, Random Forest and Neural Network typically give high model lifts. On model interpretability, algorithms such as SHAP and LIME provide ML feature contributions. Using an ensemble of models such as XGBoost and Random Forest can also yield better results. Cross-validating helps to find the optimal model parameters, and out-of-time validation enhances the stability of the model. The observed model lift on the validation data at the second decile is about 3.5x and is able to capture about 70% of customer churn.

Identify the valuable customers churning

Customer lifetime value (CLTV) refers to the past, present and future value of a customer. A bank’s best customers are those who currently generate, have generated in the past, or are expected to generate in the future, high income for the bank. An initial or less complex version of CLTV involves the calculation of the past and present value of customers.

Formulate retention strategies

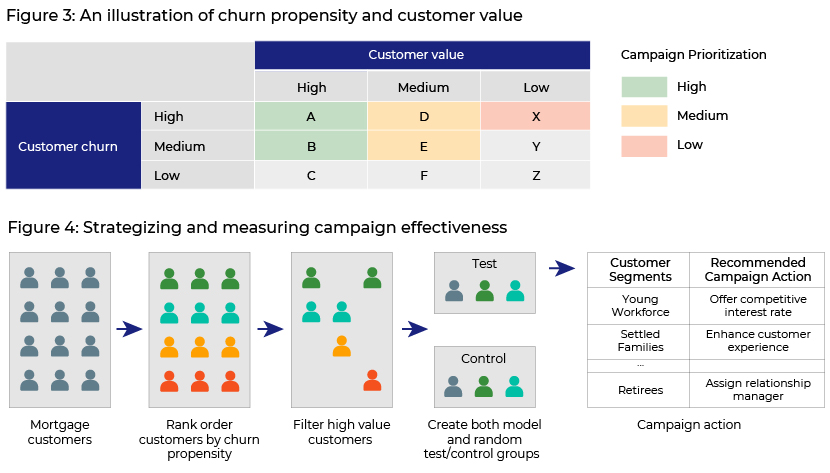

A 3x3 matrix of customer value and churn propensity can assist in the identification of customer groups to design retention strategies. These customer groups, in combination with life-stage segmentation of customers, can enhance campaign personalization. To measure true model and campaign lift, it is important to create test and control groups from the entire population as well as from the top two model deciles (high churn group). In turn, retention campaigns can target customer segments with relevant offers (such as competitive pricing or discounted rates to interest rate-sensitive customers) or actions (such as enhancing customer experience through personalized recommendations or mortgage and investment planning and increasing awareness about digital services).

Implement strategy effectively through clear communication and KPI monitoring

By adopting a data-driven churn management approach, banks can maximise their long-term profitability and reduce revenue leakage. For these institutions, levelling down or keeping steady the customer attrition rate and revenue loss from attrition can serve as a measure of model and campaign effectiveness. Through efficient change management, KPI monitoring and collaboration with businesses, product managers, and marketing, customer relationship management (CRM) and other teams, banks can put into place effective retention strategies.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners (Acuity) has been providing research and analytics services for over 18 years to more than 300 buy-side and sell-side firms globally. Our dedicated data science practice was launched in 2019, supported by 15 years of experience in providing quantitative and technology solutions to our clients. Acuity’s data science team of over 70 professionals works closely with 220 technologists and 2,000 analysts to provide digital insights by analyzing structured and unstructured datasets.

Tags:

What's your view?

About the Author

Mrinal has 11+ yrs. of experience in delivering data-driven insights to financial services clientele using supervised and unsupervised modeling methodologies. Prior to joining Acuity, Mrinal worked with Accenture’s Applied Intelligence Group for Financial Services and Citibank in their Advanced Analytics team.

Like the way we think?

Next time we post something new, we'll send it to your inbox